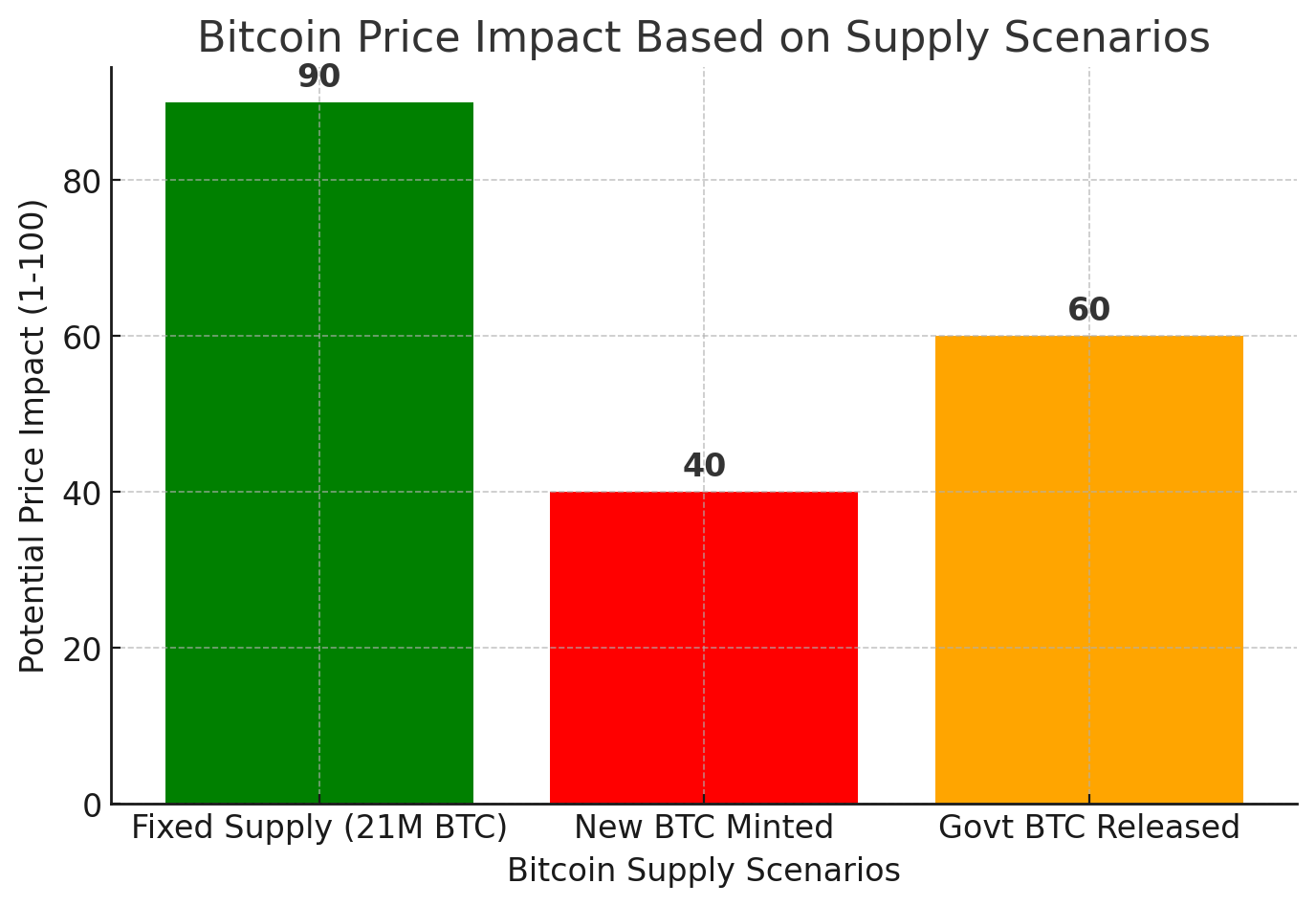

Impact of Bitcoin as a Reserve Currency What Happens if New Bitcoin is Added?

Bitcoin has been officially declared a reserve currency by U.S. President Donald Trump, but the confiscated Bitcoin holdings will remain untouched for now. However, if new Bitcoin were to be introduced or if the U.S. government were to release its seized Bitcoin, it could significantly impact the market. Let’s explore the potential outcomes.

1. If New Bitcoin is Added: Supply Increase and Market Effects

Bitcoin’s economic model is built on a fixed supply cap of 21 million BTC. If the Trump administration or any governing body decides to introduce new Bitcoin, it would disrupt Bitcoin’s core principle of scarcity. The potential consequences include:

Inflationary Pressure: Increasing Bitcoin’s total supply could dilute its value, reducing its appeal as a scarce digital asset.

Loss of Investor Confidence: If Bitcoin’s predetermined scarcity is altered, it could erode trust in the asset, leading to panic selling.

Shift to Alternative Cryptocurrencies: A loss of Bitcoin’s unique selling proposition could push investors toward assets like Ethereum, Litecoin, or decentralized finance (DeFi) tokens.

2. If the Government Sells Its Bitcoin Holdings

If the U.S. government decides to liquidate its confiscated Bitcoin reserves, it could trigger a supply shock and potential price declines. Possible outcomes include:

Short-Term Price Drop: A sudden influx of BTC into the market could cause a temporary price crash.

Institutional Accumulation: Large investors and corporations may take advantage of the dip to buy Bitcoin at lower prices, stabilizing the market in the long run.

Increased Market Volatility: Speculation over when and how the government will sell its BTC could create uncertainty and market fluctuations.

3. If No New Bitcoin is Added: Scarcity and Bullish Potential

If the Bitcoin supply remains fixed and no additional BTC is introduced, the cryptocurrency’s reputation as “digital gold” could be further solidified. In this scenario:

Price Appreciation: Official recognition as a reserve asset could increase institutional demand, driving Bitcoin’s price higher.

Stronger Supply-Demand Balance: A stable supply with growing adoption could push Bitcoin to new all-time highs.

Market Stability: Preserving Bitcoin’s scarcity could enhance investor confidence and long-term price stability.

If new Bitcoin is introduced or if the government releases its holdings, Bitcoin’s price may face downward pressure due to increased supply and potential loss of trust. However, if Bitcoin’s fixed supply remains intact, it could strengthen its position as a scarce asset, driving long-term appreciation.

? Forecast: If Trump’s administration fully embraces Bitcoin as a reserve currency while maintaining its scarcity, we could see a major long-term bull run. ?

Comments